Your Retirement Planning Specialist

I believe with the threat of rising taxes and ever-changing IRS tax laws, it is critical to have a plan for generating a tax efficient, retirement income that will last for your lifetime.

– David Jobe

Based in Murfreesboro, TN

What I Do

Everyone dreams of retiring without the stress of rising taxes, unexpected market downturns, or the fear of running out of money.

At Premier Income Planning, I help families achieve that peace of mind by offering solutions that protect against rising taxes, shield assets from untimely market corrections, and secures retirement income cash flow for your entire life.

What I Do

Everyone dreams of retiring without the stress of rising taxes, unexpected market downturns, or the fear of running out of money.

At Premier Income Planning, I help families achieve that peace of mind by offering solutions that protect against rising taxes, shield assets from untimely market corrections, and secures retirement income cash flow for your entire life.

Our Process

Our process is conveniently broken down into three phases:

Free 30-minute Introductory meeting

- I’ll introduce you to the Personal Economic Model® and calculate how long your money is projected to last into retirement.

- I’ll answer The Four Most Important Financial Questions.

- I’ll clearly outline my fee/compensation structure upfront, ensuring everything is transparent and easy to understand.

Educate

- I’ll work with you to maximize your financial efficiency by identifying, reducing, or eliminating any unnecessary Wealth Transfers.

- You’ll learn why it’s important to protect your income, assets, and your family’s future and how to guarantee what you want to happen will happen.

- You’ll learn how to best pay for cars, weddings, and other large capital purchases.

Grow

- Together, we’ll develop a future plan and compare the results to your current plan to see the impact on your retirement income cash flow and net worth.

- I’ll help you implement the Strategies and Products you approve to Secure Your Retirement Income.

- We’ll monitor and adjust the plan as necessary.

Why I Do This

Let’s face it, Retirement Planning isn’t easy for everyone. Maybe you’re unsure where to start, or perhaps you just want to know if your current plan will get you to your desired destination.

Either way, there’s no need to stress—my team is here to help.

Let’s talk!

Why I Do This

Let’s face it, Retirement Planning isn’t easy for everyone. Maybe you’re unsure where to start, or perhaps you just want to know if your current plan will get you to your desired destination.

Either way, there’s no need to stress—my team is here to help.

Let’s talk!

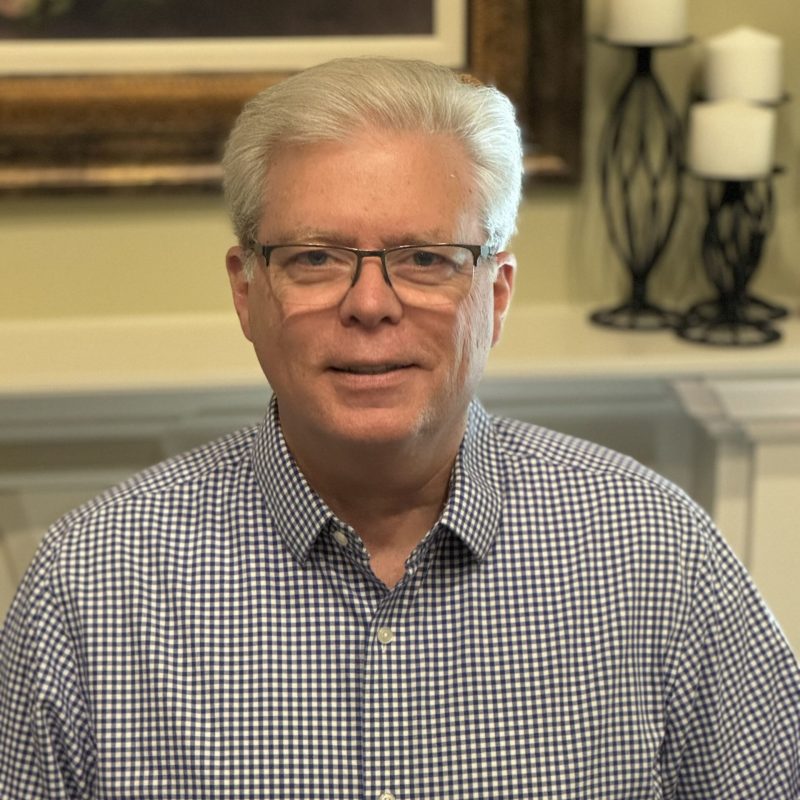

Meet David Jobe

David Jobe is the owner of Premier Income Planning, a firm he founded in December 2023. With over 40 years of financial and executive leadership experience, David has a proven track record in guiding individuals and organizations through complex financial landscapes. His expertise spans financial planning, budget management, and executive leadership, making him a trusted advisor for clients looking to secure their financial future.

Before starting Premier Income Planning, David served as the Chief Financial Officer at the Department of Veterans Affairs’ Mid-South Consolidated Patient Account Center for almost 13 years where he led financial and budget operations.

Prior to that role, he served 28 years in the United States Air Force, Air Force Inactive Reserves, and Tennessee Air National Guard, holding several key leadership positions, including Cost Analyst, Budget Officer, Comptroller, and Vice Wing Commander. In his military career, he worked on teams to develop and program 30-year life cycle costs for major weapon systems and led teams to develop and execute 1-to-3-year base level financial plans.

In addition to his military and federal service, he worked as a financial analyst at Teledyne Brown Engineering in Huntsville and as a financial advisor with New England Mutual in Nashville.

David is a Chartered Financial Consultant (ChFC®) and a member of the Murfreesboro Estate Planning Council.

David R. Jobe, ChFC®

Col, USAF (Retired)